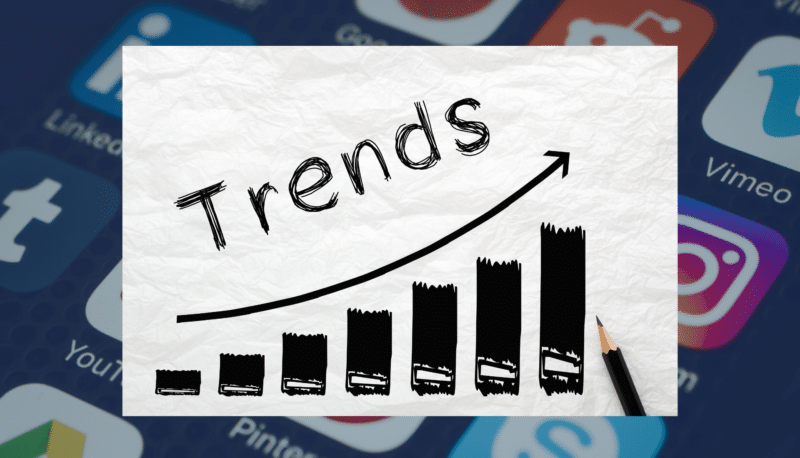

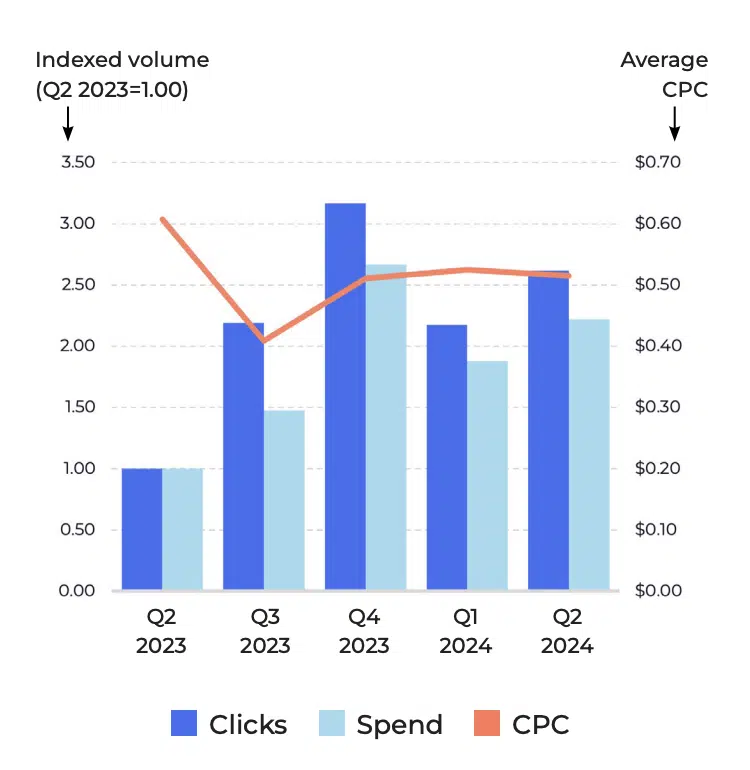

Digital advertising spending increased across retail media, paid search and paid social in the second quarter of 2024, despite rising advertising prices, according to new data from Skai.

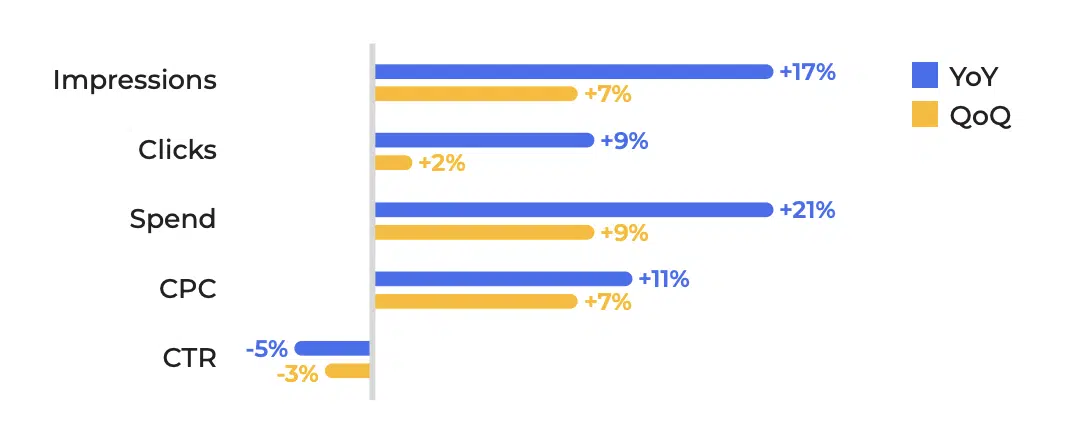

In figures:

- Retail media spending increased 21% year-over-year.

- Paid search spending increased 6% year-over-year.

- Paid social spending increased by 13% year-on-year.

The big picture. Rising advertising prices accounted for most of the spending growth, while advertising volumes (clicks and impressions) slowed or declined across some channels.

Yes, but: Despite higher prices, key performance indicators such as conversion rates have largely kept pace, suggesting improved advertising effectiveness.

Why we care. Despite higher prices, conversion rates remain stable, suggesting potential opportunities for advertisers who can effectively navigate a changing landscape and are not discouraged by all the AI updates.

Between the lines: The shift to newer ad formats like Google’s Performance Max and Meta’s Advantage Shopping Campaigns+ contributes to this changing dynamic.

- Performance Max now represents 13% of paid search spending on the Skai platform:

- Spending on Shopping Advantage+ campaigns has increased nearly 6x year-on-year, but still represents only 5% of Meta spend.

What to watch. As advertisers adapt their strategies to manage higher prices, historical trends suggest this period of price increases may be temporary.

Bottom line. Advertisers operate in a complex landscape of increasing costs and evolving ad formats, but so far they are maintaining performance through optimization and new tools.

The report. You can read the full Q2 2024 Quarterly Trends Report (PDF) from Skai.